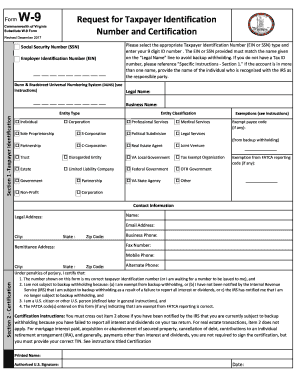

VA Substitute W-9 2022-2024 free printable template

Get, Create, Make and Sign

How to edit w 9 commonwealth of virginia online

VA Substitute W-9 Form Versions

How to fill out w 9 commonwealth of

How to fill out Virginia W-9 form:

Who needs Virginia W-9 form:

Video instructions and help with filling out and completing w 9 commonwealth of virginia

Instructions and Help about commonwealth of virginia w 9 form

ANITA A LOCAL WESTERMAN HAS FILED AN APPEAL TO THE VIRGINIA STATE SUPREME COURT CLAIMING THE CITY OF SUFFOLK AND H-R-S-D DO NOT HAVE THE RIGHT TO POLLUTE THE NANOSECOND RIVER TOM IN JANUARY WE REPORTED A SUFFOLK WATERMAN HAD SEVERAL HUNDRED ACRES OF OYSTER BEDS CONDEMNED BY THE DEPARTMENT OF HEALTH BECAUSE OF BACTERIAL POLLUTION 10 ON YOUR SIDES ANDY FOX IS HERE WITH WHY IS FILING AN APPEAL ANDY HES FILING IT BECAUSE THE CIRCUIT COURT JUDGE THAT DISMISSED THE CASE USED CASE LAW FROM 1919 THAT HE THINKS DOESN'T APPLY Any more ANDY THEY THINK TIMES HAVE CHANGED AND ARE HOPING THE APPEAL OF THIS CASE BECOMES NEW LAW THAT WILL HOLD GOVERNMENTS IN VIRGINIA MORE RESPONSIBLE FOR POLLUTING ANDY FIRST BYTE WE HAVE SEVERAL HUNDRED ACRES OF OYSTER BEDS THAT HAVE BEEN CONDEMNED BY THE DEPARTMENT OF HEALTH BY BACTERIAL POLLUTION RUNS06 RIVER THAT IS WESTERMAN ROBERT JOHNSON WHO BLAMES THE CITY OF SUFFOLK AND HRS FOR DUMPING RAW SEWAGE INTO THE NANOSECOND RIVER PROPERTY RIGHTS ATTORNEY JOE WALDO 2023 2499 THE COURT BELIEVES THEIR HANDS ARE TIED BY A CASE HANDED DOWN BY THE US SUPREME COURT 07 FIRST PASSAGE A SUFFOLK CIRCUIT COURT JUDGE WAYNE FARMER USING A 1919 US SUPREME COURT CASE THAT HELD AN OYSTER BED LESSEES PROPERTY RIGHTS TO USE THE RIVER BOTTOM IS SUBORDINATE TO THE LOCALITY RIGHT TO POLLUTE THE WATERWAYS JUDGE WAYNE FARMER SUFFOLK CIRCUIT COURT JUDGE 1953 2499 THE LAW ALLOWS THEM BECAUSE THEY ARE THE GOVERNMENT TO DISCHARGE RAW SEWAGE AND STORM WATER RUNOFF THE NANOSECOND RIVER REGARDLESS OF WHETHER IT POLLUTES THE RIVER RUNS 14 UNDER THESE CIRCUMSTANCES THE GOVERNMENT HAS THE RIGHT TO POLLUTE THE WATER JUDGE FARMER SECOND PASSAGE C THE 1919 LAW PRE-DATES NEW ENVIRONMENTAL REGULATIONS THE CLEAN WATER ACT IN A SOUTH CAROLINA CASE IMPOSED SEVERE LIMITATIONS ON THE RIGHT TO DISCHARGE SEWAGE OR OTHER POLLUTANTS BUT THE JUDGE FARMER RULED THERE DOES NOT APPEAR TO BE ANY AUTHORITY UNDER VIRGINIA LAW ESTABLISHING THAT A NUISANCE MAY BE A TAKING 2223 2499 SUFFOLK AND HRS DO WE HAVE THE TECHNOLOGY TO TREAT RAW SEWAGE AND STORM WATER RUNOFF BEFORE YOU DUMP IN THE NR OF COURSE WE DO ANDY THE ATTORNEY REPRESENTING SUFFOLK DID NOT RETURN OUR CALLS FOR COMMENT JOHNSON AND WALDO ARE ASKING THE STATE SUPREME COURT TO AWARD AN APPEAL AND REVERSE THE JUDGMENT BELOW AND SEND BACK THE CASE FOR A NEW TRIAL MORE ON THAT PART OF THE STORY AT 6

Fill va substitute w9 identification number edit : Try Risk Free

What is virginia state w 9 form?

People Also Ask about w 9 commonwealth of virginia

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your w 9 commonwealth of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.